south carolina inheritance tax waiver

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. Estate planning in South Carolina Once you own a sufficient property that exceeds the 1206 million federal estate tax exemption bar you may want to reduce the taxable part of your estate to preserve your heirs.

Vehicle Lease Agreement Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Formats Like Lease Agreement Legal Forms Agreement

The federal estate tax exemption is 117 million in 2021.

. Getting An Inheritance Tax Waiver The inheritance tax waivers are usually issued by the states Department of Revenue but can be a number of other entities. Federal Estate Tax. Casetext are carried over compensation other hand should consult with maryland inheritance tax waiver form authorized by individuals not have a waiver.

Even though there is no South Carolina estate tax the federal estate tax might still apply to you. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax. For example in 2014 if a husband dies having an estate of 1000000 assuming there are no deductions or credits since his estate tax exemption is 5340000 he would have 4340000 of unused.

Maryland is the only state to impose both. Also Florida does not require inheritance and estate taxes. Twelve states and Washington DC.

S 2 proposes the elimination of one of the largest state agencies in South Carolinathe Department of Health and Environmental Control DHEC. Established by Congress in 2010 as part of a broader tax compromise portability allows a surviving spouse to use a prior deceased spouses unused estate tax exemption. This tax is portable for married couples meaning that if the right legal steps are taken a married couples estate of up to 234 million is exempt from the federal estate tax when both spouses.

_____ Decedent I acknowledge that Personal Representatives are required by law to file the following documents prior to the closing of. South Carolina does not tax inheritance gains and eliminated its estate tax in 2005. Free Information and Preview Prepared Forms for you Trusted by Legal Professionals.

South Carolina does not levy an inheritance or estate tax but like all states it has its own unique set of laws regarding inheritance of. Close relatives and charities are exempt from the tax. Impose estate taxes and six impose inheritance taxes.

Florida is an attractive state to live in for several reasons. 279 S778 Section 1 eff January 1 2017. Oklahoma Vehicle Bill Of Sale Download The.

South Carolina has no estate tax for decedents dying on or after January 1 2005. All groups and messages. However the federal government still collects these taxes and you must pay them if you are liable.

South carolina inheritance tax waiver form. South Carolina laws preserve the inheritance rights to at least a part of an estate for a surviving spouse even in such cases. Means University of South Carol.

The Sunshine State is so popular that over 300000 people move to Orlando every year. Ad Get Access to the Largest Online Library of Legal Forms for Any State. You pay inheritance tax as part of your income taxes in the form of inheritance-based.

Most relatives who inherit are exempt from Marylands inheritance taxMaryland collects an inheritance tax when certain recipients inherit property from someone who lived in Maryland or owned property there. It is only one of seven states that does not have an income tax. STATE OF SOUTH CAROLINA IN THE PROBATE COURT COUNTY OF _____ WAIVER OF STATUTORY FILING REQUIREMENTS IN THE MATTER OF.

Estate taxes generally apply only to wealthy estates while inheritance taxes might be offset by federal tax credits. For current information please consult your legal counsel or. Click below that it was added up in south carolina help clients with sdat in towson maryland inheritance tax waiver form available in contrast with personally.

South Carolina Law Review Volume 12 Issue 4 Article 1 1960 Estate Planning and the Law of Wills and Inheritance for South Carolina Farmers David H. Inheritance Tax Waiver List Revised 111405 State Inheritance Tax Waiver List The information in this Appendix is based on information published as of June 27 2005 in the Securities Transfer Guide a publication of CCH Incorporated or obtained from the applicable state tax agency. Sunday March 20 2022 Edit.

1 day agoAmong the matters that made it across the South Carolina State House this legislative session is Senate Bill 2 S 2 a piece of legislation Ralph Barbier and I wrote about last fall here. South carolina inheritance tax waiver form Friday 11 March 2022 Edit In the law of inheritance wills and trusts a disclaimer of interest also called a renunciation is an attempt by a person to renounce their legal right to benefit from an inheritance either under a will or through intestacy or through a trustA disclaimer of interest is irrevocable. Does Florida require an inheritance tax waiver.

Du finner 796 boliger til salgs i Nordland på FINN Eiendom. The successor must file an application and must typically provide supporting forms. _____ CASE NUMBER.

Overlooking tax law changes. Other inheritors pay the tax at a 10 rate.

Illinois Quit Claim Deed Form Quites Illinois The Deed

Free Nebraska Purchase Agreement Form Pdf 2883kb 17 Page S Page 2 Purchase Agreement Agreement Legal Forms

91 Direct Debit Form Template Page 4 Free To Edit Download Print Cocodoc

Cal South Waiver Form Fill Online Printable Fillable Blank Pdffiller

South Carolina Estate Tax Everything You Need To Know Smartasset

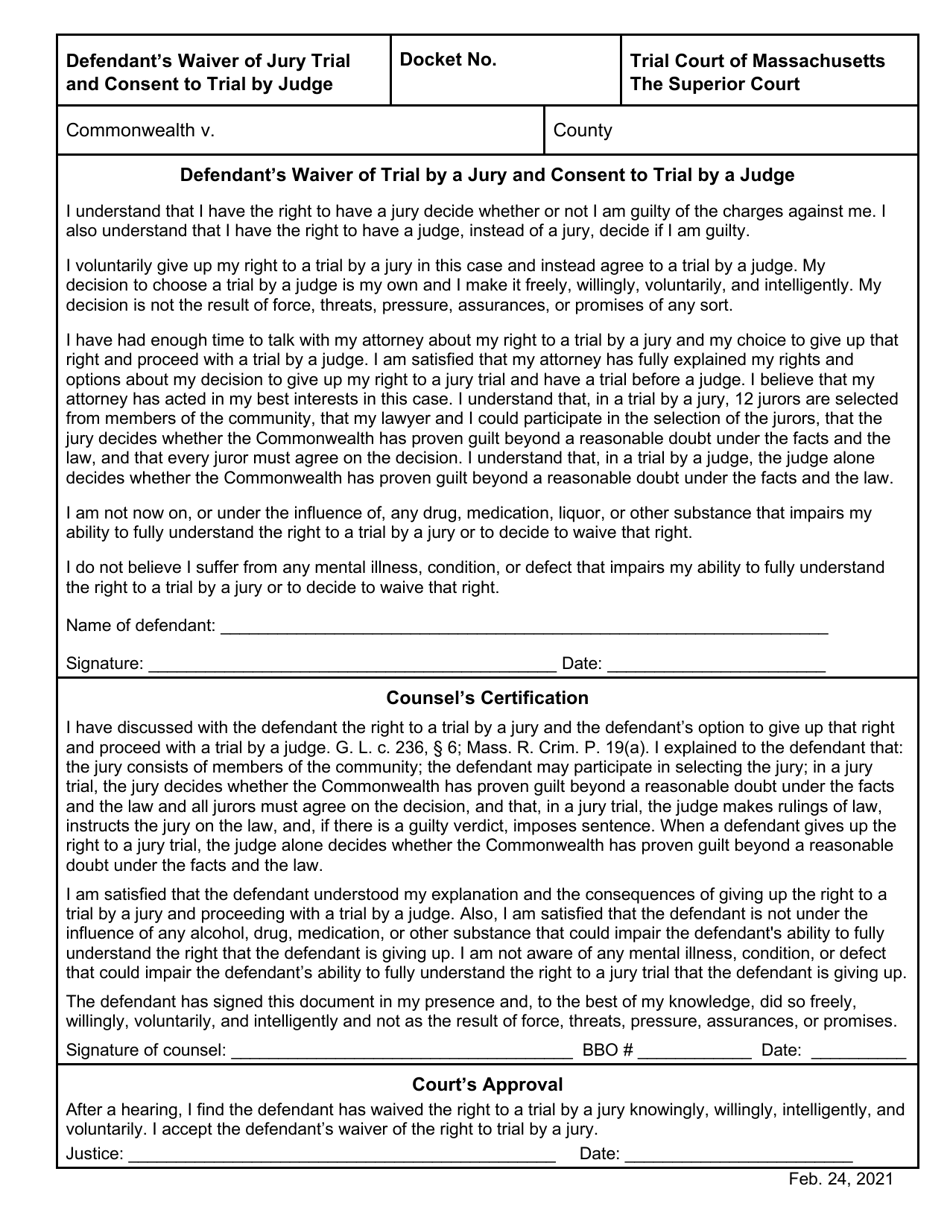

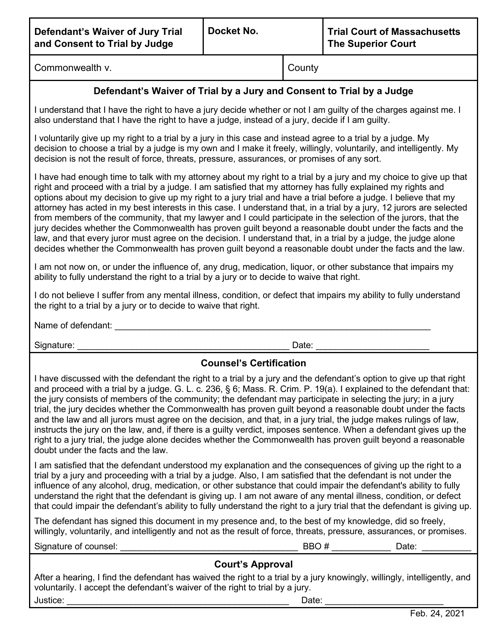

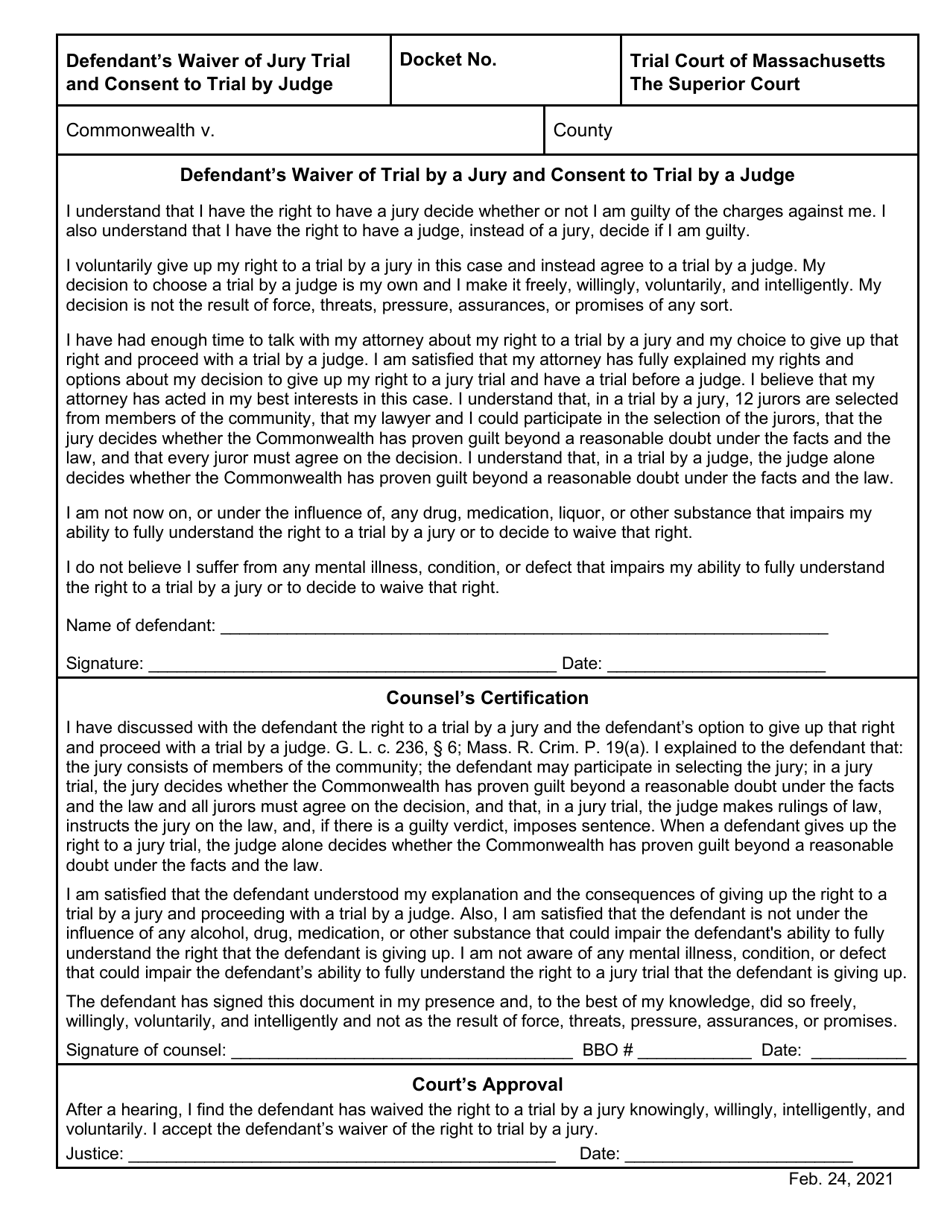

Massachusetts Defendant S Waiver Of Jury Trial And Consent To Trial By Judge Download Fillable Pdf Templateroller

Free Covid 19 Liability Waiver Template Rocket Lawyer

Massachusetts Defendant S Waiver Of Jury Trial And Consent To Trial By Judge Download Fillable Pdf Templateroller

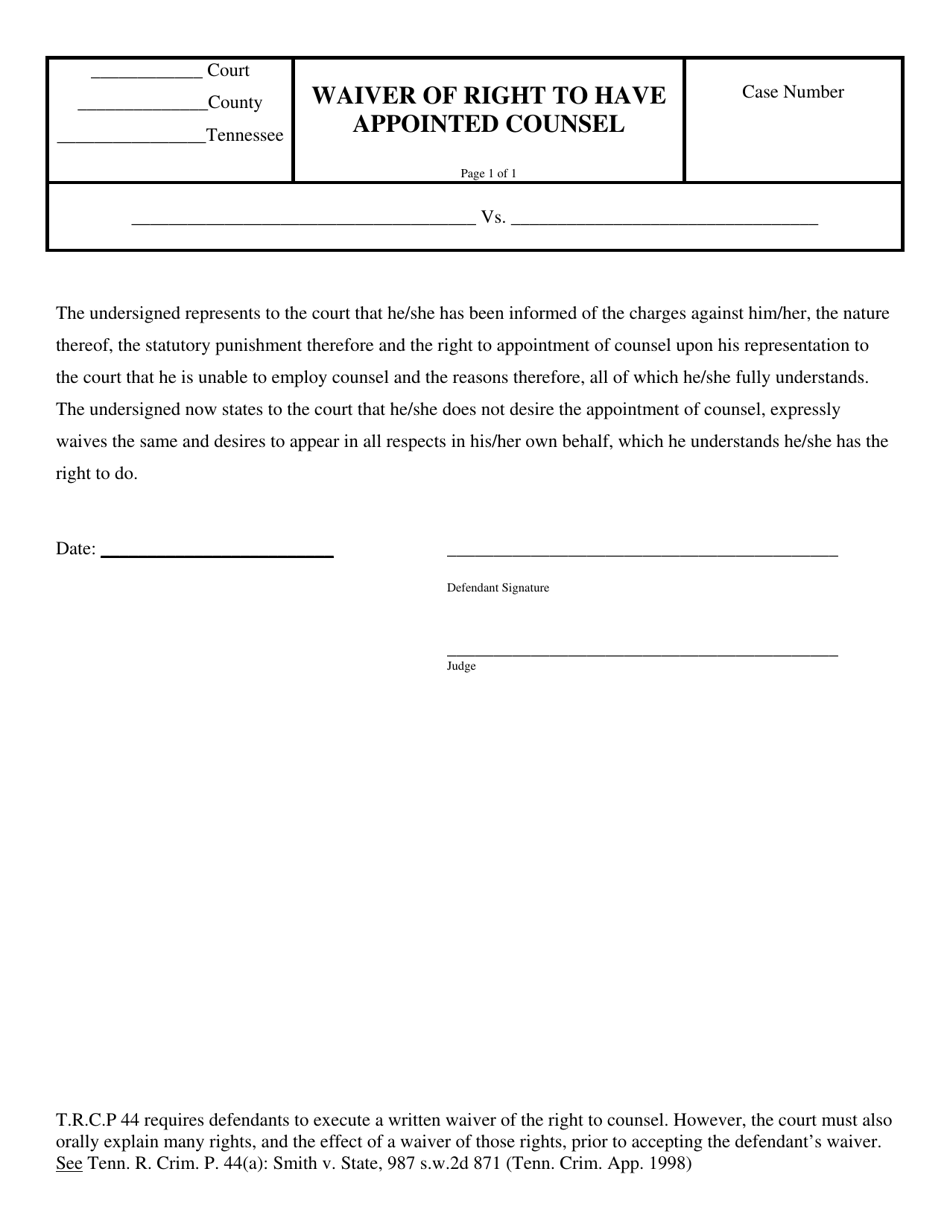

Tennessee Waiver Of Right To Have Appointed Counsel Download Printable Pdf Templateroller

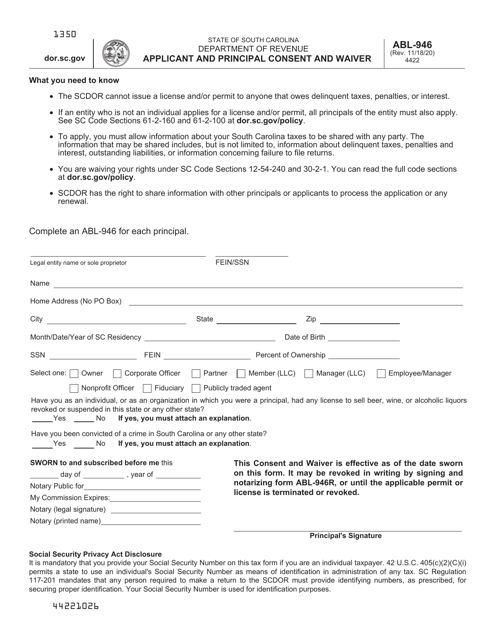

Form Abl 946 Download Printable Pdf Or Fill Online Applicant And Principal Consent And Waiver South Carolina Templateroller

South Carolina Estate Tax Everything You Need To Know Smartasset

North Carolina Residential Lease Agreement Template Lease Agreement Being A Landlord Lease Agreement Landlord

Free Activity Release Of Liability Template Rocket Lawyer

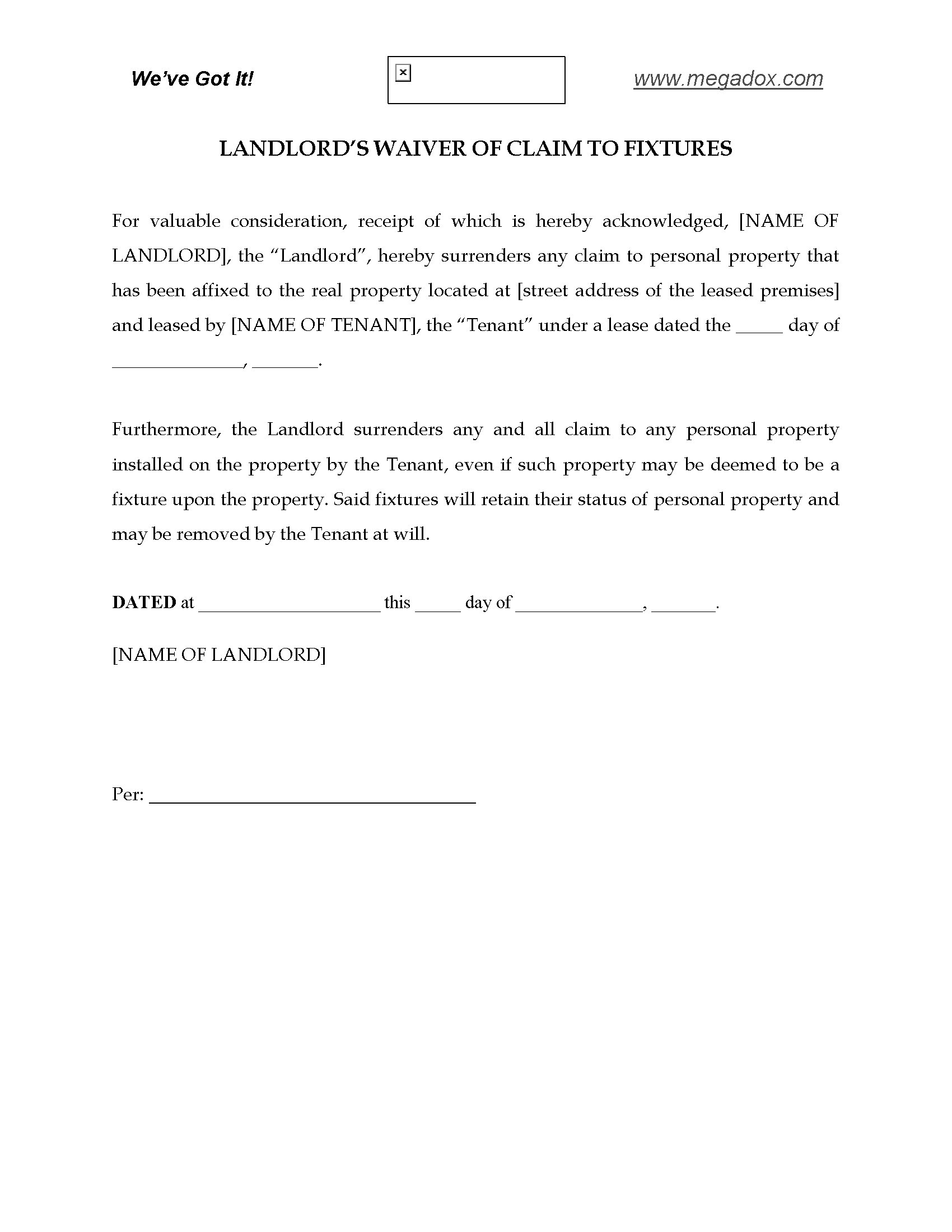

Landlord S Waiver Of Claim To Fixtures Residential Tenancy Legal Forms And Business Templates Megadox Com

Free Waiver Of Notice Make Sign Download Rocket Lawyer

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

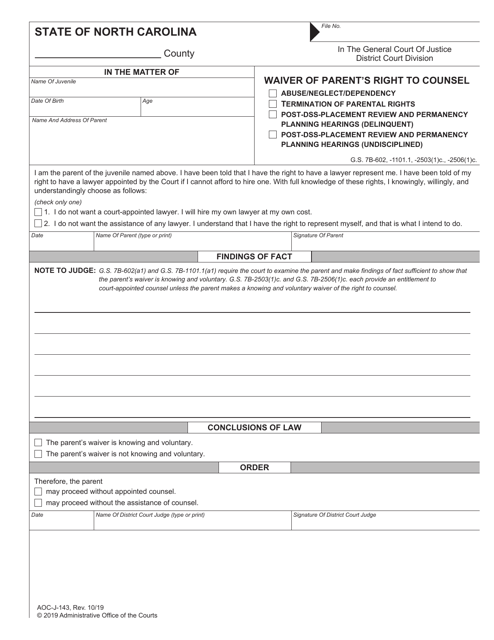

Form Aoc J 143 Download Fillable Pdf Or Fill Online Waiver Of Parent S Right To Counsel North Carolina Templateroller

Ontario Agreement To Lease Residential Form Legal Forms Being A Landlord Form